Category: Thought Leadership

Give Financial Institutions the Confidence to Lend to the Private Sector

ghanaiantimes.com.gh

The Dalex Finance and Leasing Company Limited has appealed to government to give financial institutions confidence in lending to the private sector.

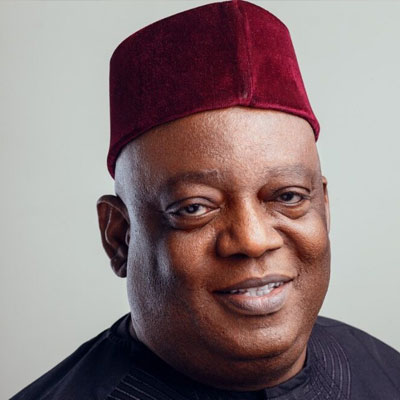

Mr Kenneth Kwamina Thompson, Chief Executive Officer of Dalex Finance, noted that financial institutions in Ghana were ready and willing to lend to individuals and businesses particularly Small and Medium-sized Enterprises (SMEs).

He said it was unfortunately that there were no ‘incentives’ for these businesses to repay the loans.

Mr Thompson stressed that if measures to facilitate funding of SMEs by financial institutions were put in place, it could help to significantly increase the country’s consumer debt to GDP ratio by approximately 19 per cent.

Mr Thompson who is also a Fellow of the Institute of Chartered Accountants in England and Wales, said neighbouring countries such as Togo, Ivory Coast and the Gambia had higher consumer debt to GDP ratios and South Africa was doing over 100 per cent.

“With a GDP of approximately $60bn, additional lending to the private sector could increase by $12bn,” Mr Thompson told the Ghana News Agency on the side lines of the tenth edition of the Business and Financial Times Ghana Economic Forum.

Mr Thompson therefore called for acceleration of the government’s digitisation drive and effective commercial courts to release private sector funding for economic development.

The Dalex Finance Chief Executive said the acceleration of government’s digitisation drive and speedy prosecution of debt defaulters by commercial courts in the country will transform the private sector.

Mr Thompson noted that with the acceleration and expansion of government’s digitisation drive, linking the databases of various statutory bodies such as the Ghana Revenue Authority, SSNIT, Land Registry, bank accounts, telecommunications and others.

He said the provision of access to these databases for a fee, will make it easier for financial institutions to assess credit risk.

Mr Thompson also, noted that the speedy prosecution of debt defaulters by the commercial courts and enforcement of court orders by bailiffs with enhanced powers will give financial institutions additional confidence to lend.

“Commercial courts must sit day and night to prosecute debt defaulters. Financial institutions are willing and able to pay for the services. Let’s make the lawyers and the judges rich,” he said.

“We need to release the private sector to fund economic development and financial institutions are willing and able to provide the funding”.

“Dalex Finance for instance lends only to public sector employees because we can confirm their identification, collect our money and they cannot easily run away.

“So to increase private sector lending to SMEs, government must provide the appropriate infrastructure for identification and collection, and if you don’t pay your loan, we shut you down”.

Mr Thompson noted that Dalex Finance is using digital lending model, which allowed it to continue to make salary loans without the client coming to any physical branch; “We saw the future of work as digital and prepared the infrastructure for this reality long before the global pandemic hit”.

He also tasked the corporate world to undertake talent intensity which requires the attraction and retaining the best employees and pays them well; “that is the only way to continue to deliver value to clients and shareholders”. GNA

Increase In Policy Rate Will Slow Down The Economy

Source : Ghanaweb.com | 5/26/2022

Bank of Ghana increases policy rate to 19%. Inflation rate for April is 23.6%, Ghana Statistical Service

We’re in between a rock and a hard place – Joe Jackson, Financial analyst with Dalex Finance, Joe Jackson has averred that the hike in the monetary policy rate by the Bank of Ghana will only lead to more challenges.

He explained that, the increase in the monetary rate by 200 basis point will firstly deter people from borrowing because of the high interest rate on lending.

Joe Jackson added that, government will pay more for debt servicing because banks do not lend to the private sector.

These, he said, will slow down the growth of the local economy. Speaking on Citi TV’s The Point of View programme on Wednesday, May 25, 2022, the financial analyst with Dalex Finance said, “Increasing the rate does two critical things for us, first it means that people won’t borrow and the economy will slow down. This slowdown in the economy will hit all of us.”

He continued, “The Bank of Ghana governor said the banks don’t lend to the private sector anyway so it is not a big deal but the government still borrows from banks so as the rate has gone up, the government will pay more to the banks in debt servicing. We are between the rock and a very hard place.”

The Monetary Policy Committee of the Bank of Ghana on May Monday, 23, 2022 increased the policy rate – the rate at which it lends to commercial banks by 200 basis points [19%].

This was announced by the Governor of the Bank of Governor, Dr. Ernest Addison at a press briefing on Monday.

The increase in the Central Bank’s monetary policy rate means that the cost of borrowing will go up.

The move is to tame the rising inflation in the country.

Honest Truth- Payroll Is Full

Source : citinewsroom.com | 10/24/2021

Joe Jackson, the Director of Strategy and Business Operations at Dalex Finance, has defended the Finance Minister’s advice to graduates from various tertiary institutions to find innovative ways of becoming entrepreneurs.

Speaking on the Big Issue, Mr. Jackson said this was a point he had made in the past.

“I cannot fault the Finance Minister for saying something I said pre-Covid and Post-Covid… all he did was deviate from the standard politician platitudes to speak the honest truth.”

Mr. Ofori-Atta has faced stiff criticism for his comments, where he said graduates could not rely on the government for jobs.

Speaking at a graduation ceremony at the University of Professional Studies, Accra on October 18, Mr. Ofori-Atta explained that the payroll was full because 60 percent of Ghana’s revenue was spent on the payment of salaries of public sector workers.

Mr. Jackson agreed that this was unsustainable.

“Where in the world does this happen? You need a job but does it have to come from the government,” he asked.

He also stressed that “the government is broke and has been broke for a long time” and thus cannot be expected to pay more salaries.

Mr. Jackson, however, noted that the government needed to play its part in addressing unemployment by creating conditions conducive for businesses.

“Even as the Minister of Finance was talking about entrepreneurship, are the conditions right?… That is the issue you should take him on for; do we have an enabling environment?”he quizzed.

Improved Lending To the Private Sector Will Lead To Growth

3news.com | 8/24/2021

A Financial Expert with Dalex Finance Mr Joe Jackson has agreed with President Nana Addo Dankwa Akufo-Addo’s call for the Bank of Ghana to work to reduce lending rate.

Mr Akufo-Addo has urged the central bank to work to bridge the gap between the monetary policy rate and the lending rates of commercial banks.

If this is done, the president said, it will enhance the rapid growth of the country.

“Interrogate the issue of high-interest rates in Ghana, and how the problem should be addressed to enhance the competitiveness of the private sector in the country…I believe the Bank of Ghana is best placed to lead this process of reflection and action.

“This is a gap we have to bridge if we are to realise the vision of a Ghana whose economy is globally competitive,” he said when he swore into office the newly constituted 13-member board of the Central Bank at the Jubilee House, Accra, on Friday.

Commenting on this in a tweet, Mr Jackson said “HE NADAA, I agree that Bank Lending rates seem high.

“Could it be that Govt borrowing is crowding out lending to the private sector?

“If riskless Govt bonds are as high as 17.7% then maybe even the 21% lending rate to the private sector is low.”

The board, chaired by the Governor of the BoG, Dr. Ernest Addison, includes Dr. Maxwell Opoku-Afari, First Deputy Governor, Miss Elsie Addo Awadzi, Second Deputy Governor, Charles Kofi Adu Boahen, Minister of State, Finance Ministry, and Prof. Eric Osei Asibey.

The others are Dr Kwame Owusu- Nyantekyi, Dr Samuel Nii-Noi Ashong, Mr Jude Kofi Bucknor, Mr Joseph Blignam Alhassan, Mr Andrew Adinorte Boye-Doe, Madam Angela Kyerematen-Jimoh, Mrs Comfort Ocran and Madam Regina Ohene- Darko Adutwum.

2022 budget: Ghana is broke – Financial analyst Joe Jackson

Source : PulseGhana.com | 12/8/2021

According to him, Ghana spends 50% of revenue on interest payments and 55 % on salaries hence the introduction of the 1.75% electronic transactions which covers mobile money payments, bank transfers, merchant payments, and inward remittances.

The proposed E- levy if approved by Parliament will come into effect on February 1, 2022.

The tax has since been met with mixed reactions, with Ghanaians kicking against it and stressing that it will only place an extra burden on their finances.

The minority in parliament has also announced that it will not support approval for the proposal.

Joe Jackson speaking on the development said the country is broke.

In a Twitter post, he said “Ghana is still broke! We spend 50% of revenue on interest payments and 55 % on Salaries. Govt needs to increase tax revenue else we may not be able to even borrow more. Hence the proposed E-levy.”

Meanwhile, Ken Ofori-Atta, the Finance Minister has written a letter to the Speaker of Parliament over modifications of portions of the controversial 2022 budget following public reaction.

He said, though, consultations would continue with respect to the implementation of the E-levy but “The full consequences of not passing the budget are serious. This would imply that from January 1, 2022, for the government to continue work, we would need to obtain parliamentary approval to spend in advance of the appropriation either than that, the entire government would have to shut down which will mean to name a few, no salaries for almost 700,000 public sector workers including doctors, nurses, teachers, personnel of the security services and others.”

Ofori-Atta Didn’t Tackle Real Economic Issues Raised By #FixTheCountry Campaigners

citinewsroom.com | 5/11/2021

The Director of Business Operations of Dalex Finance, Mr. Joe Jackson, says the Finance Minister’s press conference on Sunday, May 9, 2021, failed to address the real concerns of Ghanaians.

According to him, Mr. Ken Ofori-Atta only rehashed the government’s undertakings over the period which falls short of ameliorating the economic hardship.

The Finance Minister, at a press conference over the weekend, listed the government’s interventions and intended initiatives towards fixing the economy.

This follows ongoing public agitations over the high cost of living and other related challenges.

But speaking on The Point of View on Citi TV, Mr. Joe Jackson said the current anger of the people cannot be addressed by press conferences but by real actions.

According to him, the real demands of the people cannot be downplayed.

“Trumpeting your achievements does not fix my pocket and here when I talk about my pocket, I’m talking about those public sentiments that are being expressed, and the dissatisfaction in the level of unemployment with the public services, the dumsor, the roads, and the issues to do with education, security, health services, and housing which is making people unhappy and the perception of the increasing levels of corruption.”

“So telling somebody who says there is corruption, telling him about 1D1F, telling him about Planting for Food and Jobs and the others and however deep-rooted these may be in truth does not solve his or her problem.”

Speaking on the same programmme, the Deputy Finance Minister Designate and MP for Ejisu, Dr. John Kumah, said the government has among other things created over two million jobs in its effort to minimize the burden of citizens.

“The jobs created by this government is over two million in the last four years, and this was presented to Parliament from the Ministry of Labour by the sector Minister during his vetting, and this covers all programmes of the government including Planting for Food and Jobs, 1D1F and the rest” he noted.

Growing Income Inequality Still Not Addressed

3news.com | 5/10/2021

A financial analyst and Chief Operations Officer at the Dalex Finance, Mr Joe Jackson, has expressed dissatisfaction regarding the responses of the Finance Minister Mr Ken Ofori Atta on the call to fix the local economy.

Mr Jackson described the list of achievements outlined by the Finance Minister at a press conference on Sunday May 9 as ‘dodgy’ accomplishments that do not “address the growing income inequality or the joblessness.”

In a tweet, he said “The responses from the government are extremely tone deaf. The list of ‘dodgy’ accomplishments does not address the growing income inequality or the joblessness. I am in black.”

Mr Ofori Atta had said at the press conference in reaction to the #Fixthe economy movement that “I acknowledge that these are challenging times for many of us, and we, like almost all the countries in the world, are living through rough weather. A time that has put a burden on the necessities of lives and livelihoods never like before in recent history. Unfortunately, these external shocks have heightened Ghana’s perennial problems, which we are committed to address.

“In extraordinary times, you should expect exceptional leadership from your Government. I truly believe we cannot ensure exceptional leadership without a collective effort. So, I commend the youth for calling on Government and leaders to be at their best. This shows the patriotism of the Ghanaian youth, echoing the President’s call to Be a Citizen, Not a Spectator. You have elected us to solve the problems that face this country. We will continue to work with you and other stakeholders to do just that.”

He further listed a numbers of initiatives put out by the government to fix the economy.

He said “First, I am working with the Minister for Water and Sanitation to immediately ensure potable water to areas with felt need, especially in the most urban areas. Second, I am working with the Ministers of Roads and Highways, Transport and Interior to address congestion along the major highways.

“Third, we are fast-tracking the implementation of the US$200million Jobs and Skills Programme to enhance job creation significantly. This intervention is designed to facilitate new and expanded private sector businesses to employ a lot more people. This we believe is a more sustainable way to rebuild this economy instead of expanding Government employment schemes. Fourth, starting this month, we are rolling over 8 additional interventions under the GhanaCARES ‘Obataanpa’ programme. These will be in the Health, Agriculture, Tourism, Trade, Digitization, Science and technology, Housing and financial services.

Financial Injustice

Ghana Business News | 4/28/2021

Dalex Finance and Leasing Company Limited (DALEX) on Tuesday diagnosed the Ghanaian economy and affirmed that the bane of the country is “the injustice of Ghana’s Financial Sector”.

Mr Kenneth Kwamina Thompson Chief Executive Officer of Dalex Finance in an interview with the Ghana News Agency at Tema stated that: “…there is an injustice in the Ghanaian financial sector that has persisted for decades. Now it feels like a non-issue.

“It has become part of the status quo and people have accepted it as normal. This is a system that provides security with one hand and denies sharing of returns with the other hand”.

Mr Thompson described as financial injustice, a system which allows the banks to collect deposits, lend it to the Government – they buy treasury bills or to their customers at up to 35 per cent, per annum at the end of the month.

“Go ahead to charge the customers for the privilege of keeping their money and pay most of them nothing-most banks pay less than 5 per cent on savings account and nothing on current accounts or a few some coins at best, this is injustice which must stop,” he said.

Mr. Thompson said: “It is an insult to say Ghanaians are greedy, everybody wants good returns on their hard-earned cash”.

The Dalex CEO revealed that the banks could do better for their customers, “if they want to, stressing that “it’s quite sad that for decades, Ghanaians have settled for next to nothing from the financial institutions that they save with.

“The massive financial sector crisis and clean-up added fuel to the fire of this injustice and now people feel it’s more than enough to settle for just safe”.

He said despite the injustice, some financial institutions still offered safety, and high returns, stressing that there were credible players in Ghana’s financial sector.

He therefore advised investors and the public to seek financial advice before deciding whether to continue transacting business with their traditional bank or change direction, “the financial injustice must stop”.

The Dalex CEO said customers must look out for financial institutions with “the triple reward of safety, peace of mind, and high returns”.

Mr Joe Jackson, Dalex Finance Director of Strategy, also explained to the GNA that four years after the sector clean-up, the Bank of Ghana was exercising much tighter control over the financial sector, adding “Efforts to restore faith in the security of the financial system are important because confidence in the financial sector is key to its development.

Mr Jackson noted that the SME sector was the engine of growth, and growth could only be possible if there was a viable financial sector to support SMEs to deliver prosperity and create jobs.

He suggested that other means to address the financial injustice was for the financial institutions “to add perks like no charges on any transactions, wholly digitised systems for customer convenience and full transparency on all operations; it’s safe to say that Ghanaians don’t have to settle for just safe anymore”.

Dalex Finance is a wholly Ghanaian owned and operate Specialized Deposit-taking Institution (SDI) licensed by the Bank of Ghana (BoG) and has been in operation in Ghana since 2006.

Since 2013, Dalex Finance began the process of becoming a digital finance company with the objective of delivering its products and services with speed and convenience.

Currently, Dalex Finance is capable of originating and disbursing loans and investment products digitally and employs over 3000 persons through 102 sales points nationwide.

Strategically, Dalex Finance offers financial services in rural and peri-urban areas.

The Poor to Be Hit Hardest By Newly Proposed Taxes

Economist Joe Jackson is concerned that Ghanaians at the lower level of the economic ladder will be the worst hit by the government’s proposed new taxes and levies.

He said while the taxes apply to every Ghanaian, they will come out as very harsh to the poor since the majority of them use consumables and the least change will significantly affect their personal economies.

Speaking on The Point of View on Monday, Joe Jackson said the proposed 30 pesewas increment of fuel prices as part of the new levies will consequently affect the price of goods and services.

“When you impose a consumption tax, it hits the poor harder than it hits the rich because as a percentage of my income, fuel does not constitute that importance [but] when you go down the bottom of the ladder, transportation to work and back is a major headache. Every cedi increase causes you [the poor] more trouble, and it affects everything and everybody– the cost of food, the cost of drinks, everything.”

The government, through the caretaker Minister for Finance, Osei Kyei-Mensah-Bonsu in delivering the 2021 budget last week announced the government’s proposal of introducing six new taxes.

These taxes include a COVID-19 Health Levy; 1% increase in the National Health Insurance Levy and 1% increase in flat VAT rate as well as a 30 pesewas increase in fuel prices to take care of excess power capacity charges [20 pesewas] and Sanitation and Pollution Levy [10%].

The others include a gaming tax, review of existing road tolls and a financial sector clean up levy of 5% on profit before tax.

The 30 pesewas increase in fuel prices has been one of the most topical issues following the announcement with many Ghanaians expressing fears that it will lead to transport fares shooting up and consequently increase in the cost of other goods and services.

According to Joe Jackson, a better alternative could be targeting the rich with taxes such as property tax and luxury vehicle tax among others.

He said the government must be deliberate in targeting wealth and taxing wealth rather than introducing taxes that severely affects the poor.

“They [government] should tax wealth and not VAT,” he suggested.

Meanwhile, business journalist, Toma Amihere, who was also on the show on Citi TV warned that Ghana’s debt level was alarming and remains the major stumbling block preventing Ghana from developing at an expected pace.

He said he believes government must do more to collect taxes from those supposed to be paying taxes to free the poor from the burdens of additional taxes.